Pittsburgh, PA – A Pennsylvania mother’s experience with a $1,000 theft from her digital banking account has ignited a fierce debate about the security and customer service practices of fintech companies like Chime. After her account was hacked, Chime denied her fraud claim twice, refusing to refund the stolen funds despite clear evidence of unauthorized access.

The woman, who used her Chime account to manage monthly payments for her son’s braces, found herself locked out and notified of a suspicious transaction requesting $500. Her credentials were changed days before she noticed, confirming the breach. However, when she reached out to Chime’s fraud department, the company concluded that “no error has occurred,” dismissing her claims and leaving her without her money—and trust in the platform.

The Alarming Incident: Unauthorized Access and Denied Claims

Initially, the mother hoped for a swift resolution after reporting the fraud. She described her shock when, despite Chime’s system showing login attempts from an unfamiliar location and funds transferred to another user, her dispute was rejected twice within 48 hours.

“I don’t understand how any bank that has any sort of insurance can turn their back on you like that,” she said.

Before even speaking to a live representative, users face automated warnings that confirmed fraud cases might not be refunded—a process that has frustrated many customers like her.

Community Voices: Widespread Concerns Over Chime’s Fraud Policies

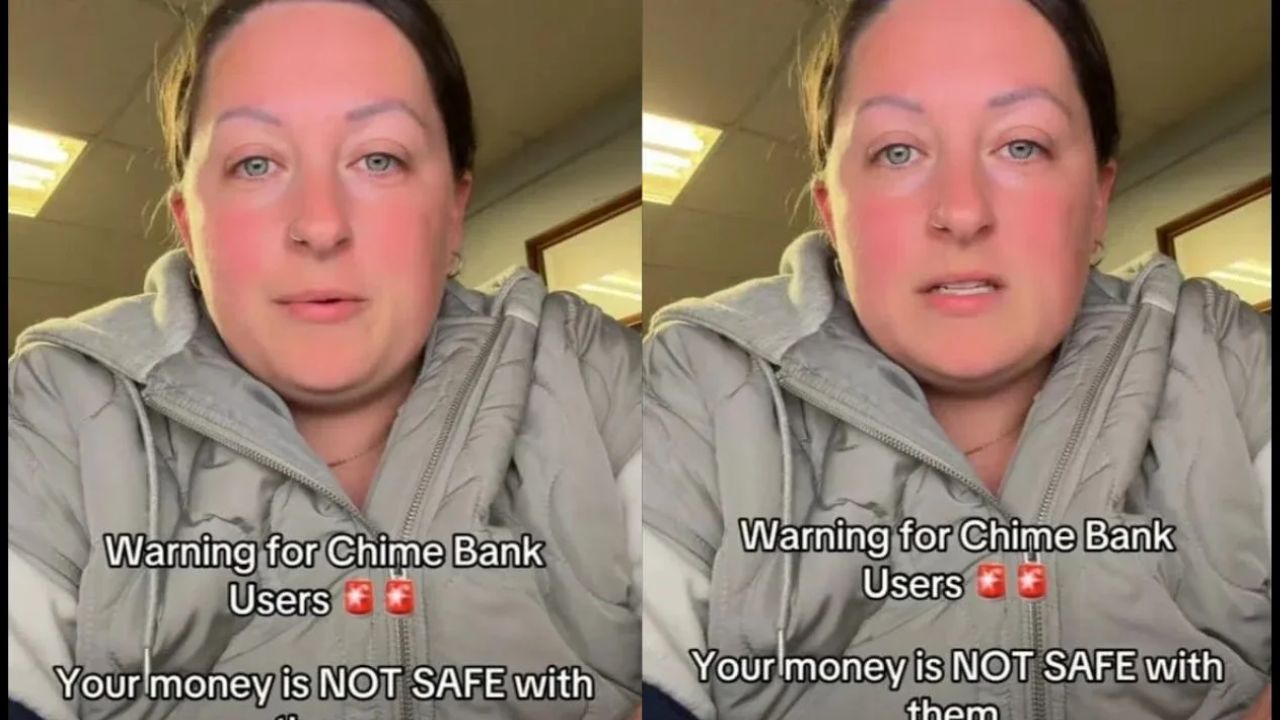

The viral TikTok video underscoring her story led to thousands of responses from users sharing similar hardships with Chime, including:

- Claims of stolen funds with minimal assistance.

- Accounts being closed after fraud reports.

- Money transfers to other accounts without authorization.

Critics point out that Chime is not a traditional bank and lacks FDIC insurance, emphasizing its status as a fintech tech company rather than a federally insured institution.

“They’re not FDIC insured — they’re a tech company, not a real bank,” noted one commenter.

Support for Chime and Broader Fintech Challenges

Despite the backlash, some longtime users defend Chime based on their smooth experiences and prompt issue resolutions. But fintech experts warn that digital banks often suffer from inadequate human support systems to handle complex fraud disputes effectively.

Chime partners with federally insured banks; however, customer service delays and slow fraud responses remain points of contention. You can read more about this ongoing issue at Fat City Feed.

The Impact: Personal Loss and a Warning to Others

For the affected mother, the lost funds were meant for a critical expense—her son’s braces. Now, she urges others to reconsider where they entrust their money.

“Don’t do business with them. Pull your money out. Put it somewhere else. Chime will not have your back,” she warned.

Read Also: California Man Arrested in Mexico for Attempted Body Smuggling After Fatal Domestic Incident

What Can Customers Learn from This Incident?

- Always monitor accounts closely for unusual activity.

- Understand the protections your digital bank offers before depositing funds.

- Be cautious with fintech platforms that are not federally insured banks.

Have you experienced fraud with digital banks like Chime or Cash App? What do you think about this discovery? Share your thoughts in the comments below and join the conversation on consumer protection in digital finance.

by

by