CALIFORNIA—

SB 436, a bill that would extend the time tenants have to pay overdue rent from three days to 14, is expected to return soon for another vote in the Assembly Judiciary Committee.

The bill passed the Senate (26–10) in June but has since stalled. It may be reconsidered following renewed pressure from tenant advocates.

Bill author Senator Aisha Wahab says SB436 will extend the notice period for renters to pay or move out from three days to 14 days, bringing California in line with Massachusetts, Minnesota, New York, Tennessee, Vermont, Virginia, and Washington.

“By extending the notice period to pay rent or move out, SB 436 will allow both parties to avoid the expense and burden of court proceedings by providing a renter with additional time to pay,” according to Wahab.

She adds that the bill is crucial for making emergency rental aid more effective, helping prevent evictions and ensuring landlords get unpaid rent.

A renter can be evicted even if they come up with the money

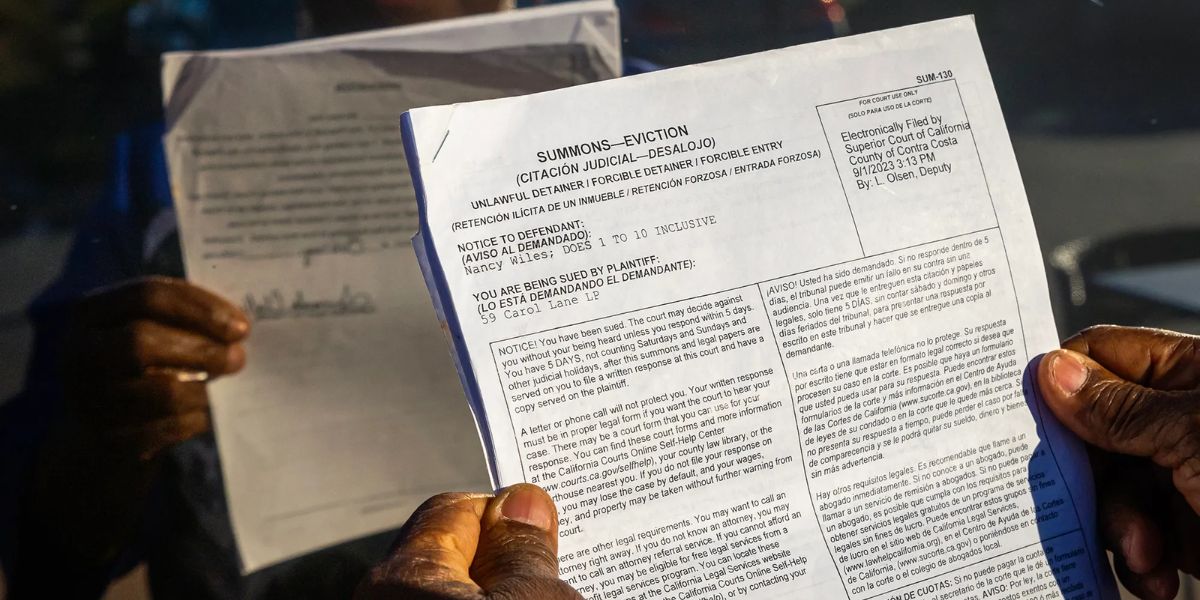

Evictions for unpaid rent typically begin with a three-day notice to pay or leave. If the tenant doesn’t comply, the landlord can file an unlawful detainer (UD) complaint and serve it along with a summons.

Under current law, once a UD action begins the eviction process, a renter can be evicted even if they are able to pay all of the rent due at some point before the eviction process is complete.

For example, even if the tenant came up with the amount of rent owed on the fourth day after receiving a notice, the landlord could refuse to accept payment and the tenant could still be evicted.

The author and co-sponsors say three days isn’t enough for many low-income Californians to secure funds from family, employers, loans, or rental aid.

Critics say it delays rent payments until the middle of the month

The California Apartment Association (CAA) opposes the bill, arguing it “would allow tenants to unilaterally delay their rent payments until the middle of each month, regardless of financial need or mutual agreement with the housing provider.”

CAA adds that the bill forces housing providers to act as involuntary creditors, “forcing them to provide housing without receiving payment on time, even when tenants are not facing financial hardship.”