The California senate has adopted a measure that will ideally encourage studios to shoot in the state by boosting the maximum amount of tax credits from $330 million to $750 million.

“More than doubling the program’s allotted cap to $750 million annually underscores just how vital our industry is to the economic health of our state, and the power of our members’ voices,” the Entertainment Union Coalition stated in a statement. “The strength of our members’ voices is demonstrated by the fact that our industry”

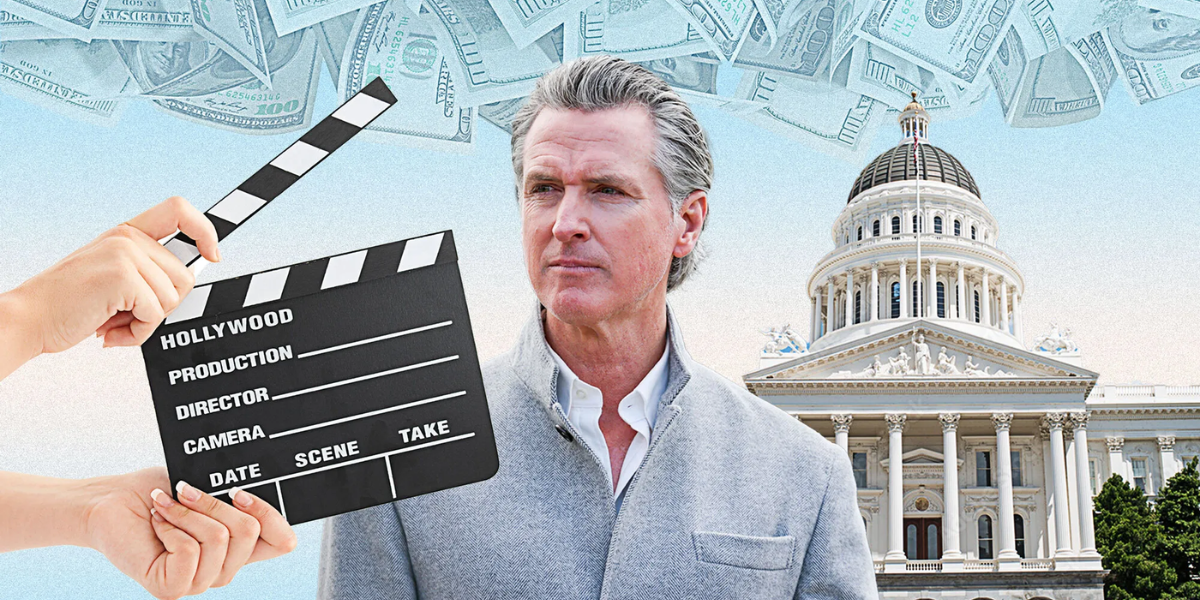

In recent years, Los Angeles has battled to maintain its supremacy in the industry, losing business to other states that provide more lucrative incentives, most notably New York and Georgia. Los Angeles has been regarded the heart of film and television production nationwide for a long time. The idea was presented in October by Governor Gavin Newsom and Mayor Karen Bass of Los Angeles in an effort to close the deficit.

The office of Newsom has stated that they anticipate the governor would sign further legislation as part of the expansion of the tax credit.

Rick Chavez Zbur, an assemblymember who represents portions of Los Angeles County, expressed his approval of the expansion of the tax credit’s scope.

“After years of uncertainty, workers can once again set the stage, cue the lights, and roll the cameras—because California is keeping film and TV jobs anchored right here, where they belong,” Zbur stated in an interview.

A bill called Assembly Bill 1138 was written by Zbur with the intention of enhancing and modernizing the film tax credit program.

“This is a historic investment in our creative economy, our working families, small businesses, and the communities that depend on this industry to thrive,” he remarked to reporters. “We’re not just restarting production—we’re rewriting the script to put workers back at the center of California’s entertainment future.”

Since 2009, the tax credit has been responsible for the creation of 197,000 employment and the generation of $26 billion in economic activity, according to the office of Zbur.

by

by