The first step is to stamp an envelope with the phrase “Important Tax Document.” In the event that you choose to disregard it, your bank account can feel as though it has been submerged in liquid nitrogen one month later. If you fail to pay a tax bill, the Internal Revenue Service (IRS) has the authority to levy, which is another word for seize, the money that is in your bank account. Only in the previous year, the agency distributed more than 313,000 requests for levies to financial institutions and brokers.

This is how it operates, as well as how you may prevent the Internal Revenue Service from seizing your money in such a sudden manner.

How a levy gets on the launchpad

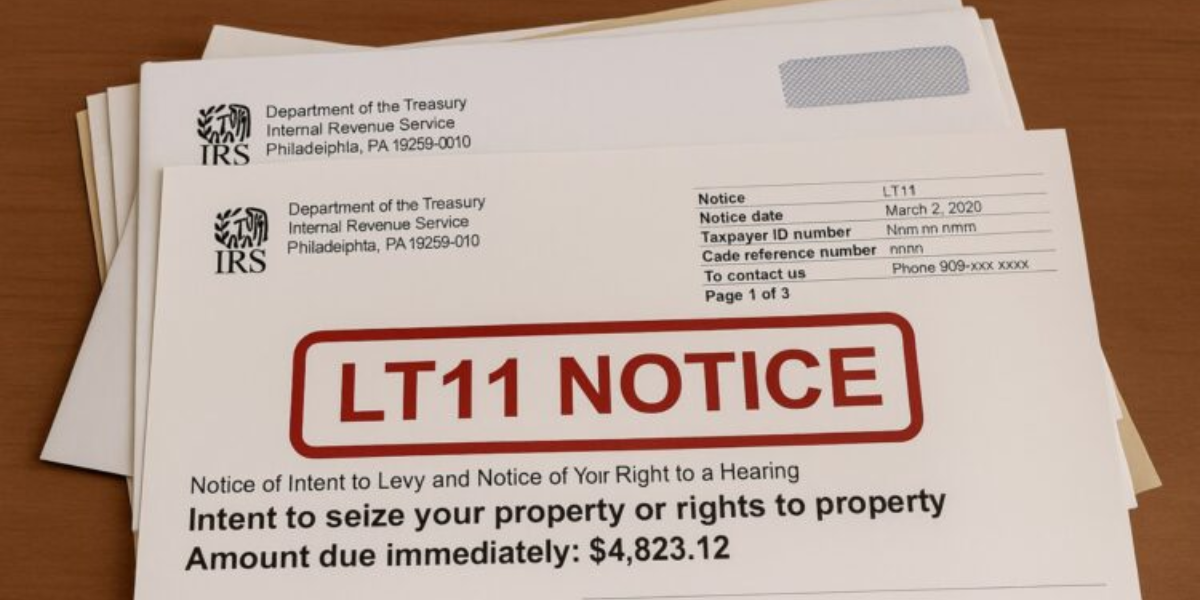

Your debt that is owed to the IRS is the first step in the assessment process. The next thing that arrives in your mailbox is a regular bill. In the event that you choose not to make the payment, the agency will send you a Final Notice of Intent to Levy and Your Right to a Hearing, which is Letter LT11 or CP90, through certified mail at least thirty days before the action begins.

That letter’s date allows you to do the following:

- Pay In Full Online.

- If the debt is less than fifty thousand dollars, you should set up a short term plan.

- In order to contest the numbers, you should request a hearing under the Collection Due Process (CDP).

The IRS computer is free to call your bank in the event that you do not meet the 30-day deadline.

Once your bank receives a notice of levy, it is required to put a hold on your funds, up to the amount that you are responsible for paying. In accordance with federal regulations, you have twenty-one days to make things right before the money is transferred to the Treasury. The hold provides an opportunity to demonstrate that the amount is incorrect, demonstrate that the levy causes “economic hardship,” or negotiate a payment arrangement.

Cash that stays and cash at risk

There is only the money that was in the account on the day when the freeze was implemented. Paychecks that are cleared after the levy, new Zelle deposits, and even a tax return that arrives later are among the things that are typically exempt from the seizure. Despite this, a large frozen debt can cause you to lose your rent, your car insurance, and any automatic drafts that you forgot to set up.

The Levy by the Numbers

- During the fiscal year 2024, there were 313,792 notices of levy issued to third parties.

- According to the IRS Data Book, the average amount of individual tax debt that is currently being sent to collections is $17,852.

- A legal limit? Not at all. At one point in time, the agency took $1.9 million out of a single account in the year 2023.

- There is a 21-day bank hold that is mandated by the Code of Federal Regulations.

Five Escape Routes Before Day 22

You are able to communicate and negotiate with the Internal Revenue Service agents; they are not stone statues. There are a few things you can do in the event that you do receive the dreaded letter:

- You must pay everything. Quick and easy, yet obvious.

- Short-term extension of a contract. Within the first 180 days if the balance is less than $100,000.

- Form 9465, Installment Agreement. The payments are spread out over a period of seventy-two months, and the charge is lifted after it has been approved.

- Offer in Compromise. Demonstrate to the Internal Revenue Service that you are unable to pay the entire freight amount; the average approved offer from the previous year was twenty-four cents on the dollar.

- The Hardship Release. Demonstrate that essentials such as rent and utilities will not be paid; the Internal Revenue Service has the authority to release the levy even if you are in full payment of the debt.

As day 22 approaches, the money are transferred to the Treasury, and the penalties continue to accumulate at a rate of up to one percent every month. In addition to the federal short-term rate, the interest rate is five percent higher. The payoff does not remove the black mark; credit bureaus will continue to view the federal tax lien that was created as a result for seven years.

Rachel, a graphic designer from Phoenix, threw her CP504 into the pile of things that were considered trash mail. After receiving three alerts, her bank froze $4,100, which was an amount of rent money that she intended to move that afternoon. As a result of a speedy appeal for hardship, half of the levy was released; however, the remaining portion of her vacation money was depleted due to the late rent cost and a new monthly penalty of 0.5 percent.

by

by