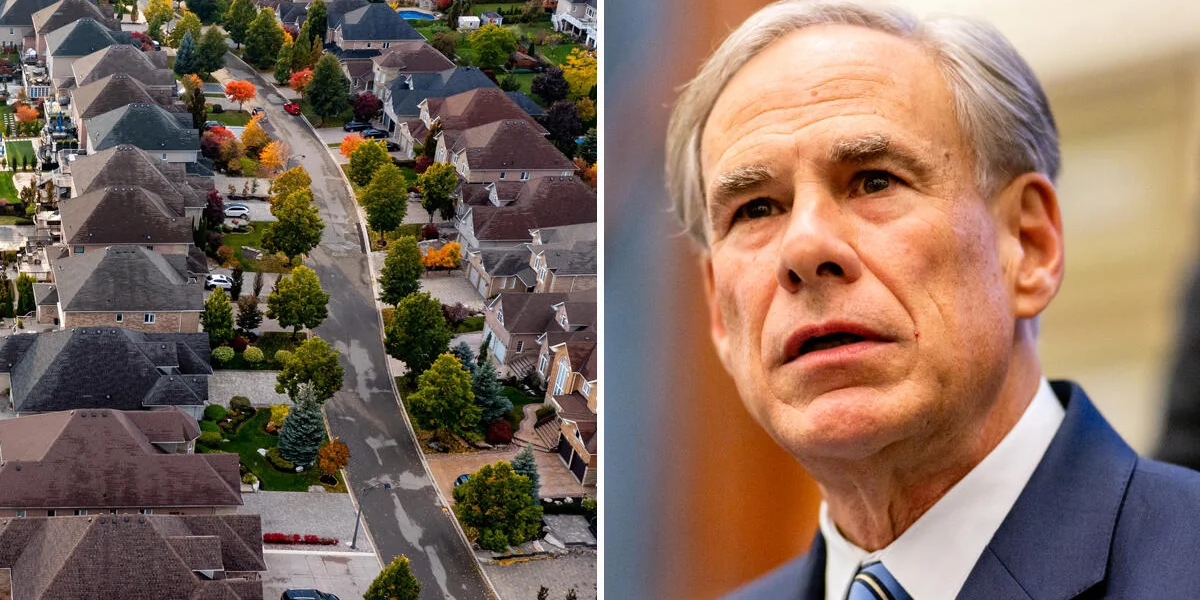

As of Monday, Governor Greg Abbott of Texas signed three measures that, according to him, will provide additional relief from property taxes to millions of homeowners and companies in the state of Texas.

House Bill 9, Senate Bill 4, and Senate Bill 23 were all legislation that Abbott signed into law during a ceremony that took place at the Robson Ranch, which is a retirement community located in Denton.

At this point, it is up to the locals and proprietors of businesses to make it official. The amendment to the Constitution must be approved by the voters during the election that will take place in November.

Texas House Bill 9 (HB 9)

With the passage of House Bill 9, the exemption for business personal property tax will be increased from $2,500 to $125,000.

Senatorial Bill 4 of Texas

Additionally, the entire homestead exemption will be increased from $100,000 to $140,000 as a result of Senate Bill 4.

Bill 23 of the Texas Senate

According to Senate Bill 23, the exemption for homeowners who are disabled or who are 65 years of age or older will be increased to a maximum of $200,000.

In what way does this relate to cost savings?

It is estimated that the typical homeowner will save approximately $500 more on their property taxes, and when you add up the savings from 2023, which are still in force, the total amount of savings is approximately $1,750.

In addition, those who are disabled and those who are 65 years of age or older will receive an additional $900, bringing the total savings to more than $2,300. The potential savings may amount to approximately $2,500 if there were an increase in exemptions for enterprises.

When it comes to homeowners, the homestead exemption will only be reflected in the school property tax, which is the element of the bill that accounts for the highest amount.

In order to pay public schools, the state will divert a smaller portion of the money collected from property taxes and instead rely more on the state sales tax and other state resources.

For proprietors of businesses, the rise in their exemption will be reflected in the city, county, and school property taxes that they are required to pay.

The Governor elaborated on the significance of the constitutional amendment by providing an explanation.

“We want to make sure we do more than pass a law for this session that could be overturned by a majority next session,” Abbott stated in his speech. “We want to make sure we pass laws that are enduring that would require two-thirds votes, which mathematically would mean concerning a tax not in the lifetime of anyone in this room, are you going to get a two-thirds vote to increase the tax?”

In the future, the governor has expressed his desire to establish additional restrictions that will prevent municipalities and counties from raising their property taxes.

Will Abbott exercise his right to veto the Texas ban on cannabis products containing THC?

In spite of the fact that the focus of Monday is on property tax relief, Governor Abbott is coming under increasing pressure to make a decision on Senate Bill 3, a contentious piece of legislation that has the potential to have a significant influence on the hemp business in Texas.

There is less than a week left until the prohibition on THC will automatically become a law without the necessary signature from the governor. If it were to become law, the majority of its provisions would go into force on September 1st.

The deadline for Abbott to make a decision is the 22nd of June.

by

by